From ‘Pharmacy of the World’ to becoming the preferred outsourcing destination for innovative scientific solutions, India’s Life Science industry has seen a dramatic shift. Driving this change is the contract research development manufacturing organization (CRDMO) industry, which witnessed a CAGR of 15% between 2019 and 24, double the global growth rate of 7%–8%. Given this pace, it has the potential to hit $25 billion in revenue by 2035 and is poised to become a global leader in the CRDMO space—clarifying CRDMO meaning as end-to-end contract research, development, and manufacturing under one roof.

However, what are the reasons behind this unprecedented growth? How did it all evolve, and what challenges lie ahead? This article dives deep into the Indian CRDMO sector to answer these questions and more. To set context, this viewpoint explains the CRDMO meaning, tracks the rise of the CDMO industry, and outlines what it signals for the pharmaceutical industry in India.

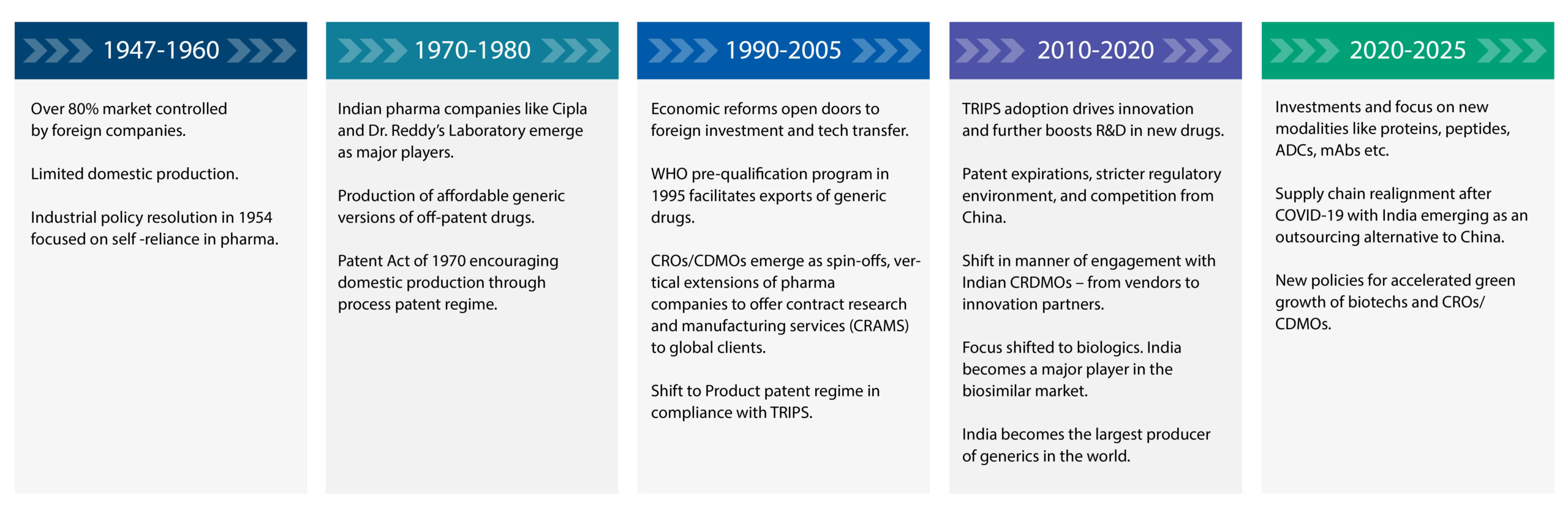

Evolution of the pharmaceutical industry in India and growth of Indian CROs-CDMOs

The pharmaceutical industry in India initially evolved from manufacturing basic generics of off-patent drugs for the domestic market in the 1970s to becoming the largest producer of generics by volume by 2010. In 2023-24, it had a 20% share in the global supply of generic drugs and a 60% share in the supply of low-cost vaccines. With exports worth $27.9 billion, today it is the third largest producer of pharmaceuticals by volume and 14th largest by value2.

The success of Indian pharma companies in generics development and manufacturing created a foundation for technical expertise, regulatory knowledge, and cost-efficiency among India’s talent pool. This paved the way for the CRO-CDMO industry. The timeline below traces the evolution of this industry¾ from pharma companies to CROs-CDMOs over 75 years.

Strategic shift in partnerships across the cdmo industry

Initially, Indian CROs/CDMOs were hired by US pharma companies to execute relatively simple, scientific work. All these companies were looking for was a capable pair of hands¾ scientists who could follow instructions without any deviation and deliver reliable science at a low cost.

However, by 2016, a distinct shift occurred in the manner of engagement. With patent expirations, stricter regulatory environment, and rising competition, it was imperative for biopharma companies to forge strategic partnerships to innovate and commercialize breakthrough therapies faster to capture market share. Consequently, global companies began seeking out larger Indian CROs-CDMOs to solve multi-dimensional problems with multi-dimensional solutions, including delivering them at an accelerated pace.

Notably, Indian CRDMOs did not disappoint. They quickly rose to the challenge, expanding their services to support new drugs and formulations, including biologics.

Factors driving the change

Several factors drove the CDMO industry shift, including scientific expertise, innovative platforms, faster startup time (90% faster), lower workforce cost (70%-80% lower cost), and lower infrastructure set-up cost (85% lower cost) as compared to the West1. Needless to say, small and medium-sized biotechs were the first to capitalize on these advantages.

It is not unusual for small biotech companies to be rich in ideas. However, with limited funding and success riding on a handful of molecules, their business model does not include investment in infrastructure, a sizeable workforce, and the skills needed to handle the complexity of drug development and regulatory milestones. This gap is bridged by the Indian CRDMOs and, in the process, they partner and co-innovate with their clients.

For instance, Syngene has built an integrated drug discovery-development (IDD) platform,¾ an archetype for the CRDMO approach within the CDMO industry that offers clients end-to-end advice, planning, and support. This platform, which spans the full breadth of the drug discovery and development value chain, is set up to handle complexities to help biotechs move their molecules from laboratory to market faster and more efficiently than they could on their own.

An emerging biotech company successfully leveraged our IDD services to take their molecule designed to treat a rare liver disease from early discovery to the clinic. We not only helped define the product’s regulatory starting materials but also successfully developed the manufacturing process to improve the throughput and quality of the product.

To date, our innovative solutions, including IDD, have earned the company 400+ patents filed jointly with clients across drug discovery, development, and manufacturing.

Changed perception of large and medium biopharma companies

The change in perception about the Indian CRDMOs was not limited only to small biotechs. Large and medium-sized biopharma companies also began to see value in partnering with Indian CRDMOs for their ability to address specific challenges, i.e., niche skills and expertise not available in-house, access to state-of-the-art infrastructure requiring high capital investment, ability to navigate regulatory complexities, ability to innovate, etc.

A case in point is Baxter and Bristol Myers Squibb (BMS) who partnered with us for a unique service termed Dedicated Centers. In this business model, we have set up a ring-fenced infrastructure exclusively for Baxter and BMS with a dedicated team of Syngene scientists supporting them in their R&D programs. The distinctive feature of this model is its ability to offer complex services, at scale, tailored to the client’s specific requirements. This is later integrated with the client’s systems and programs. Both partnerships have thrived for over a decade, even as cost arbitrage has diminished. The reason behind this is the high level of expertise, and innovation being delivered, year-on-year.

Another example underscores why sponsors choose CRDMO partners: Zoetis, the largest animal health company in the world, which signed an agreement with us to manufacture one of its mAbs. This was for a drug substance for Librela® (bedinvetmab) for treating osteoarthritis in dogs, and a potential blockbuster drug for Zoetis. Fully aware of the complexity of mAb manufacturing and its challenges in scale-up, process optimization, and regulatory scrutiny for quality, Zoetis decided to partner with us. With both teams working collaboratively, we were able to deliver innovation at every turn. Consequently, Zoetis achieved EMA and US FDA approvals for Librela and ensure commercial supply in the EU and US markets per timelines.

Pandemic impact & Supply Chain realignment across India’s pharmaceutical hubs

In 2020, the COVID-19 pandemic drew global attention to the role of India in the biopharma supply chain. By providing COVID-19 diagnostics, therapeutics, and vaccine R&D services in an accelerated timeframe, Indian CRDMOs cemented their research and development capabilities beyond doubt.

Another big change was the realignment of global supply chains. With China in complete lockdown mode for more than a year, the entire world turned to India for sourcing key starting materials (KSMs) for their R&D programs. India’s proximity to emerging markets in Asia, Africa, and the Middle East positions it across India’s pharmaceutical hubs as a source of cost-effective biotech exports and services.

This trend is continuing even today, with new developments like the passing of the US BIOSECURE Act adding momentum. The Act, which seeks to enhance US biosecurity, restricts federal agencies from engaging with China-based biotechs. As a result, companies looking for alternative suppliers and R&D partners to derisk their supply chain are increasingly turning to India.

India's expertise in emerging modalities

According to a BCG-IPSO report1, next-gen modalities will drive future growth (2025 and beyond) at a CAGR of 30-40%. In line with this trend, Indian CRDMOs are making investments in emerging modalities like protein, peptides, ADCs, bispecific, DNA-RNA therapeutics, and mAbs, to drive the future of science and healthcare. Many of the larger CRDMOs have already acquired expert capabilities to stay ahead in the game.

Syngene, for example, has built its own proprietary platform, SynWeave, for protein production. With this platform, we have been able to achieve a four-fold increase in titer for its clients, significantly enhancing efficiency and reducing costs. The platform effectively addresses issues related to low yield and lengthy processes, enabling the production of high-quality clones ideal for mAb manufacturing.

Challenges ahead

The outsourcing story will not be complete without mentioning the Trump administration’s sweeping reforms to enforce the ‘America First’ policy. Apart from retaliatory tariffs, the US government’s recent push to reshore drug manufacturing, including APIs, KSMs, and raw materials, is a cause for concern for Indian CRDMOs. If implemented strictly, the new policy could restructure the US generic supply chain, resulting in India losing the cost advantage it has enjoyed for years.

Another concern is the likely mandate to disclose the source of APIs used in drug manufacturing. Although Indian pharma firms and CRDMOs produce many formulations domestically, they rely heavily on Chinese imports for APIs. This could put them under further scrutiny in the US market and hurt their business prospects.

Internally, Indian CRDMOs face several pressing challenges. These include gaps in talent (quality and quantity), lack of policies and regulations to ensure ease of operations, need for a world-class, end-to-end supplier ecosystem, increased funding to move up the technology curve, and commitment to sustainability to have an equal play.

Role of government in fostering biotechnology and the pharmaceutical industry in India

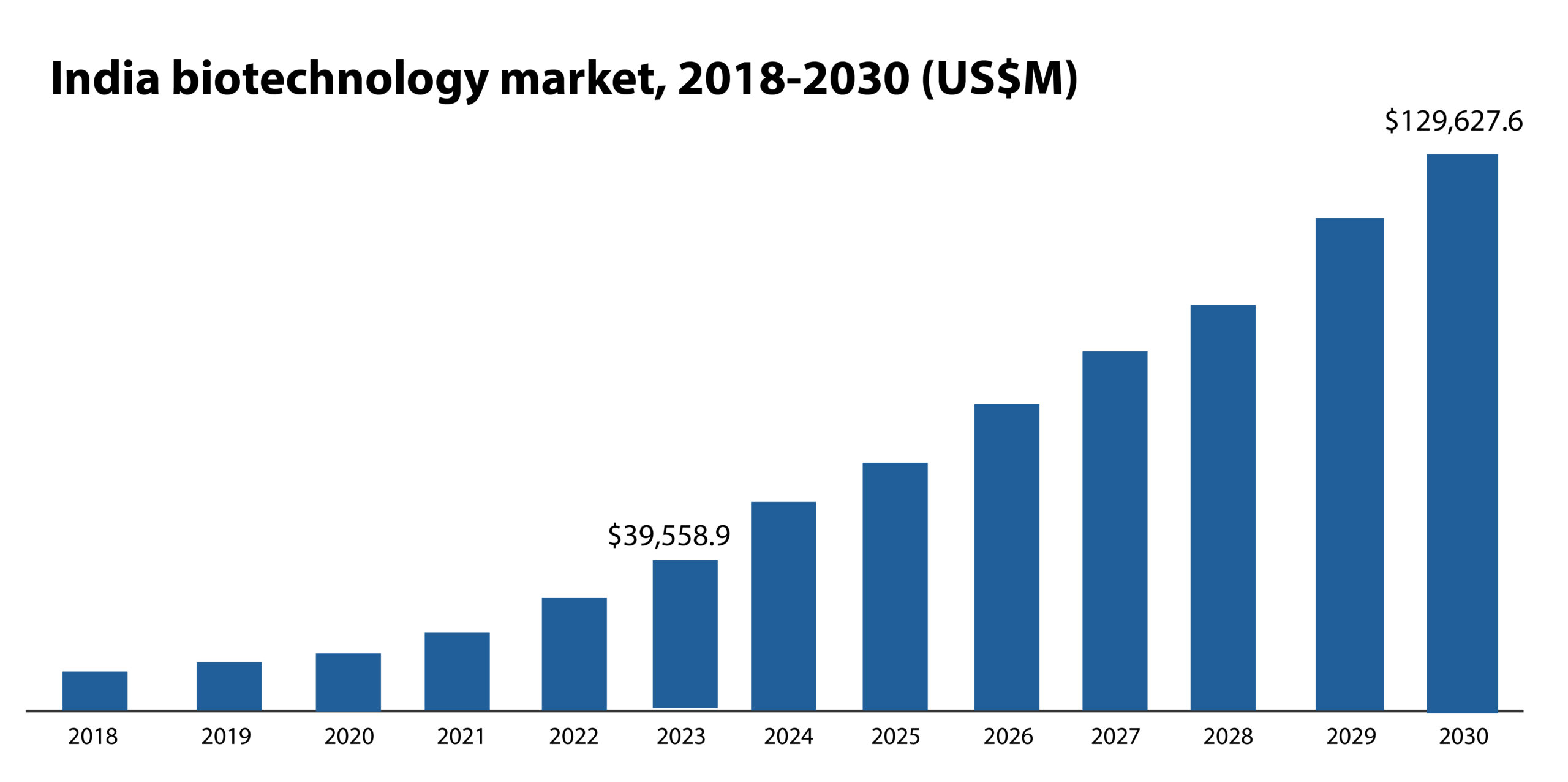

The biotechnology market in India is expected to reach ~US$ 130 billion by 2030 from ~US$ 39 billion in 20233. The industry is projected to grow at a CAGR of 18.8% between 2024 and 2030. Recognizing the potential of this sector to transform the economy, the government has allocated INR 20,000 crore ($2353 million) to support private sector-driven research in FY2025-264.

Already, the Department of Biotechnology – Biotechnology Industry Research Assistance Council (DBT-BIRAC) has played a significant role in transforming the startup ecosystem across the country. From 350 startups prior to 2014, India now has 9000 biotech startups. In FY 2024-25, the Biotechnology Innovation Fund for Accelerating Entrepreneurs (AcE) mobilized investments of >INR 1200 crore for biotech startups and SMEs.

More recently, the Union Cabinet approved DBT’s BioE3 policy for fostering high-performance biomanufacturing. This is expected to drive innovation support for R&D and entrepreneurship across identified sectors. It will also accelerate technology development and commercialization by establishing Biomanufacturing and Bio-AI hubs and biofoundries.

The new policies seek to improve workforce skills, provide access to funding, promote public-private partnerships, reduce supply chain vulnerabilities, promote green growth, sustainable practices, and more. With CROs/CDMOs struggling with the very same challenges, the reforms are expected to deliver much-needed relief and impetus to the CRDMO sector as well.

Future Outlook

While numerous challenges still exist for the Indian CRDMO sector, the future outlook remains strong. Firstly, Indian CRDMOs have come to resemble their global clients more closely than ever before – in terms of their problem-solving skills, innovative mindset, and adherence to global quality standards — making it easier for clients to collaborate with them.

Another positive development is the passing of the US Inflation Reduction Act. The pricing pressure unleashed by this policy is expected to drive more outsourcing work to India. Industry has also begun to take the lead in addressing challenges related to biopharma outsourcing. For example, Syngene, along with 10 other CRDMOs in the country, has come together to launch the Innovative Pharmaceutical Services Organization (IPSO). This consortium will provide a common platform to drive advocacy, build an ecosystem of innovation, and address critical challenges such as supply chain resilience and regulatory efficiencies. Such collaborative efforts not only strengthen India’s position in the global biopharma landscape but also create a unified voice to influence policy and streamline innovation pathways.

Lastly, with the country moving towards greater maturity in intellectual property management (India is among the top 10 patent filers globally for 20245), the Indian biopharma industry is poised to move up the value chain into original research and innovation. With increasing investments in advanced technologies, digital transformation, and biologics, Indian CRDMOs are well-equipped to support next-generation therapies, from complex biologics to cutting-edge modalities like cell and gene therapies. Indeed, with its large pool of scientists, regulator-approved infrastructure, and cost advantage, India has the potential to play a significant role in biopharma innovation in the future.

- https://www.bcg.com/publications/2025/india-unleashing-the-tiger-indian-crdmo-sector

- https://www.ipa-india.org/pharmacy-of-the-world/#:~:text=The%20Indian%20pharmaceutical%20industry%20plays,data%20accumulated%20in%201990%2D2016.

- https://www.grandviewresearch.com/horizon/outlook/biotechnology-market/india

- https://dbtindia.gov.in/latest-announcement/union-budget-2025-26-reflection-dbt

- https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=2073890