In today’s rapidly evolving world, a resilient supply chain is no longer optional for the biopharma industry; it’s a strategic necessity. The journey of a new molecule from lab to market has become incredibly complex, challenged by everything from geopolitical shifts and cybersecurity threats to regulatory hurdles. Amidst these difficulties, Contract Research, Development and Manufacturing Organizations (CRDMOs) with a global presence are proving to be vital partners, bringing stability, accelerating timelines, and providing a key strategic advantage.

This is especially true for biologics. Making them is incredibly complex as they often need to be kept precisely cold during transport, and they face stringent regulations. For these advanced medicines, you simply need a supply chain that’s strong, spread globally, and linked digitally.

Why biopharma supply chains cannot afford fragility

Think about it: from COVID-19 to the war in Ukraine, we’ve had a stark reminder of just how fragile and interconnected our global supply chains are. For biopharma companies, this isn’t merely about missed deadlines; it’s about life-saving therapies failing to reach patients in their time of greatest need.

A recently published McKinsey article1 dives into the changing world of biopharma services and why it’s still a hot spot for private equity (PE) firms. Even though PE deals have slowed down lately because money is more expensive and the market’s been bumpy, this industry is still a massive $77 billion profit pool.

The article points to exciting investment opportunities in areas such as antibody-drug conjugates (ADCs), gene and cell therapies, sterile fill-finish services (which prepare drugs for injection), and systems related to GLP-1 drugs (for diabetes/weight loss).

To really succeed here, companies need to be incredibly efficient, have strong scientific know-how, and have a global supply chain of resilience.

So, being resilient isn’t just about having plan B anymore. It’s about building smarter, more spread-out systems that aren’t easily crippled by one single problem.

The hidden backbone accelerating molecule development

The pharmaceutical industry is experiencing a major shift, primarily because it’s increasingly depending on Contract Development and Manufacturing Organizations (CDMOs). Think of them as specialized partners who’ve become essential for everyone from the biggest pharma companies to agile biotech startups. They’re helping these companies innovate faster, save money, and scale up their operations more effectively. As new drugs get more complicated and regulations keep changing, CDMOs are fundamentally reshaping how we create and deliver medicines.

Essentially, CDMOs act as strategic allies, letting pharmaceutical and biotech companies hand off development and manufacturing tasks so they can focus on their strengths: research and development, marketing, and getting their products to market.

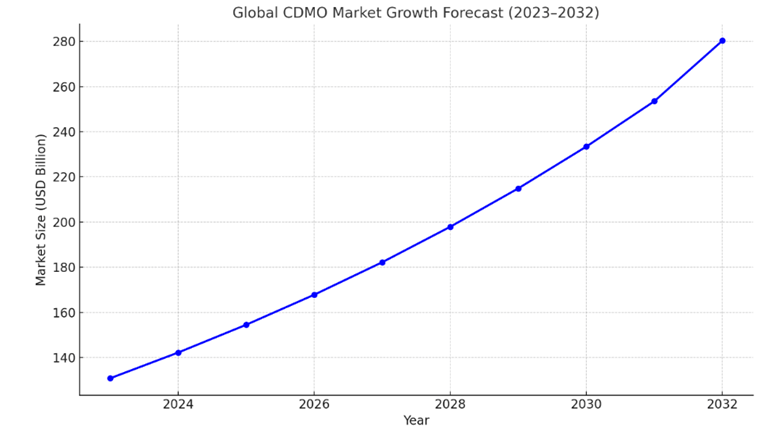

The global Contract Development and Manufacturing Organization (CDMO) market is currently undergoing significant expansion. In 2023, the market was valued at USD 130.8 billion, and projections indicate it will nearly double to USD 280.3 billion2 by 2032, exhibiting a Compound Annual Growth Rate (CAGR) of 8.7% from 2023 to 2032. This substantial growth underscores a dual trend: a rising demand for manufacturing capabilities, coupled with the increasingly complex nature of contemporary drug development.

Top 5 reasons pharma companies are turning to CDMOs?

The increasing adoption of CDMO services is driven by several key factors, both strategic and operational:

a) Cost-effectiveness and risk mitigation – Establishing advanced manufacturing facilities or biologics labs demands substantial capital investment and adherence to complex regulatory requirements. CDMOs present a compelling, cost-effective alternative. They provide access to state-of-the-art infrastructure without requiring pharmaceutical companies to incur upfront capital expenditure. This enables pharma firms to de-risk their operations and maintain an asset-light business model.

b) Speed to market – CDMOs provide manufacturing setups that are both flexible and immediately ready for use, along with established global supply networks. This capability significantly speeds up drug development and helps get products to market faster, which is a crucial advantage in medical areas with strong competition or high patient demand.

c) Specialization and Innovation – CDMOs tend to have specialized expertise in advanced drug delivery systems which allows pharmaceutical companies to access niche technologies and valuable know-how. Furthermore, driven by the growing prominence of biologics, gene therapies, and personalized medicine, CDMOs are making significant investments in research and development to support the creation of complex formulations and novel therapeutic modalities.

d) Global regulatory expertise – Navigating the web of regulatory requirements across different countries is one of the most daunting challenges for pharmaceutical companies. The diverse nature of guidelines from authorities like the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), DCGI (Drugs Controller General of India), and WHO-GMP (World Health Organization – Good Manufacturing Practices) can easily overwhelm even experienced teams. A well-integrated CDMO with a presence in both developed and emerging markets becomes a critical enabler of supply chain durability and business continuity.

e) Geopolitical realities are reshaping supply chains – Far from a distant concern, geopolitical tensions are directly challenging global biopharma supply chains, pushing companies to overhaul their established partnerships and regional reliance. Several key factors are pushing this change. For instance, the BioSecure Act, aims to prohibit US organizations from contracting with biotech companies that are seen as being influenced by foreign adversaries. Beyond specific laws, geopolitical uncertainty is a huge driver. The increasing friction between major global powers has really highlighted the dangers of putting all your eggs in one basket, especially when that “basket” is a region with political instability.

Another critical concern is the risk of intellectual property and cybersecurity. Companies are increasingly worried about their valuable research and manufacturing data being leaked or compromised through cyberattacks. This concern is leading them to choose CDMO partners in countries with stronger IP protections and clearer, more transparent regulations.

Finally, the need for operational continuity and reliability has become paramount. The COVID-19 pandemic, with its export restrictions and widespread supply disruptions, exposed just how vulnerable single-region supply chains can be. Now, companies are prioritizing operations across multiple continents to ensure they can consistently get the materials and manufacturing support they need, no matter what happens.

To summarize, biopharma companies are likely to work with partners who can:

Mitigate IP leakages

Operate in geographies aligned with their core markets

Flexibly scale as demand or crises arise

Accelerate their molecule to market by reducing development and manufacturing timelines

Key checks for biopharma companies towards building resilience supply chains

If your biotech company has U.S. government contracts, or works with clients who do, you need to start rethinking how you operate to avoid these “companies of concern.” Here’s what companies should consider:

- Check your entire supply chain: Look closely at all your suppliers, including those involved in research and development, to see if you’re exposed to countries, especially those already named in the Biosecure Act.

- Plan your exit strategy: This is tough but start figuring out how to switch away from current partners. Pay close attention to things like termination fees, penalties for breaking contracts, and royalty fees that might come up when you make a change.

- Spot potential roadblocks: Identify any business or legal issues that could make the switch hard or impossible. For example, getting new FDA approvals as part of a transition plan can take a very long time.

- Calculate the switching costs: Figure out how much these changes will cost your company and get your leadership to agree on how to fund these unexpected expenses.

To navigate these complexities, leading biopharma companies are proactively embracing global supply chain diversification strategies. By leveraging multi-continental CDMO partnerships, they are not only ensuring production continuity but also aligning with evolving compliance, cybersecurity, and geopolitical expectations.

Having biologics manufacturing capabilities across geographies allows companies to:

- Respond faster to regional regulatory changes

- Minimize single-point failure risks in any one market

- Ensure compliance with region-specific laws like the BioSecure Act

- Maintain inventory buffers closer to key customer markets

How Asia and North America Are shaping the future of biopharma manufacturing

By combining operations in Asia and North America, a new gold standard for the global biopharma industry is emerging. This Asia-North America model is a strategic masterpiece, meticulously balancing several critical factors that are essential for success in today’s rapidly evolving world. Firstly, it strikes the perfect balance between proximity and cost. Companies can now be closer to major markets in North America, fostering stronger relationships with clients and enabling faster responses to their needs. Simultaneously, they can leverage the established infrastructure and often more cost-effective operations available in Asia. This dual approach means optimizing resources without compromising reach.

Secondly, this model significantly enhances compliance and continuity. In an era of ever-changing regulations and unpredictable geopolitical shifts, having a footprint across two diverse continents provides inherent resilience. If one region faces new regulatory hurdles or supply chain disruptions, operations can pivot or be bolstered by the other, ensuring uninterrupted production. This mitigates risks that could otherwise derail critical drug development and manufacturing.

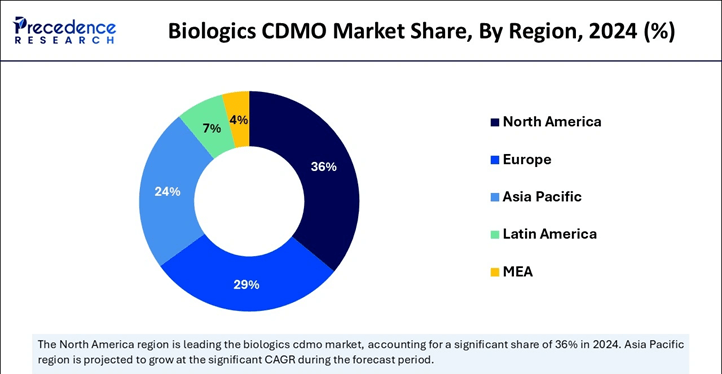

As the chart illustrates, North America continued to lead the biologics CDMO market in 2024, supported by its numerous prominent pharmaceutical and biotechnology firms, especially in the United States. Companies like Pfizer, Amgen, and Johnson & Johnson, headquartered in the region, contribute to a robust ecosystem for biologics development and manufacturing. This advantage is further strengthened by the U.S. FDA’s clear and supportive regulatory framework, which continues to drive innovation and long-term investment in biologics.

Looking ahead, the future of global biopharma manufacturing lies in the strategic integration of North America and Asia. Together, these regions offer the ideal balance of regulatory strength, innovation, cost-efficiency, and scalable infrastructure. By maintaining speed, scale, and security across both regions, companies aren’t just surviving; they’re thriving, ensuring that life-saving medicines can continue to reach patients around the world efficiently and reliably. It’s a proactive, intelligent strategy for the future of healthcare.

A case in point is Syngene, which has built a robust biologics manufacturing presence in both the United States and India. Syngene has taken a thoughtful step toward supporting its global customers by expanding its biologics operations across two continents. With its new facility in Bayview, Maryland working alongside its established base in India, the company now offers a combined 50,000 liters of single-use bioreactor capacity. This dual presence means Syngene can stay closer to its U.S. clients while continuing to tap into the expertise and scale of its Indian operations. Together, these facilities form a resilient and agile foundation to help biopharma clients confidently navigate the global landscape.

Why a resilient supply chain is a competitive advantage?

In today’s fast-changing and often unpredictable world, how strong and flexible a company’s supply chain is has become incredibly important for success in the biopharma industry. More and more, companies are leaning on Contract Development and Manufacturing Organizations (CDMOs), especially those that operate across the globe. This isn’t just about making things easier; it’s a crucial business strategy.

Instead of relying heavily on a single region, companies are now building more diverse supply chain models. They’re looking to spread their operations across key developed and emerging markets. This Asia-North America model offers the best of both worlds: in North America, particularly the U.S., companies can stay close to cutting-edge innovation and benefit from clear, established regulations. Meanwhile, Asia provides opportunities for cost-effective, large-scale manufacturing.

By combining these strengths, companies are creating smarter, more adaptable supply chains. This new setup helps them better withstand unexpected disruptions, get life-saving therapies to market faster, and ultimately ensure that patients receive the medicines they need without unnecessary delays. It’s about building a future where global challenges don’t compromise patient care.

References:

- Bischoff, C., Smith, J., Mathur Hammer, A., & Morell, J. (2025, January 29). From discovery to delivery: Finding an investment edge in biopharma services. McKinsey & Company. Retrieved June 27, 2025, from https://www.mckinsey.com/industries/private-capital/our-insights/from-discovery-to-delivery-finding-an-investment-edge-in-biopharma-services

- Precedence Research. (2024, September 11). Biologics CDMO market size, share & trends (2025–2034). Retrieved June 27, 2025, from https://www.precedenceresearch.com/biologics-cdmo-market

- Crowell & Moring LLP. (2024, June 26). Preparing for the U.S. BIOSECURE Act [Client Alert]. Retrieved June 27, 2025, from https://www.crowell.com/en/insights/client-alerts/preparing-for-the-us-biosecure-act

- Firme, A. (2025, June 18). The Rise of CDMO in the Pharma Industry: A Strategic Shift in Drug Development. SAVA Global. Retrieved June 27, 2025, from https://savaglobal.com/the-rise-of-cdmo-in-pharma-industry-strategic-shift-in-drug-development/